The power of compounding interest

Compounding interest is almost unbelievable 😲

Most of you have probably heard about compounding interest, but it’s really hard to actually understand how powerful it is.

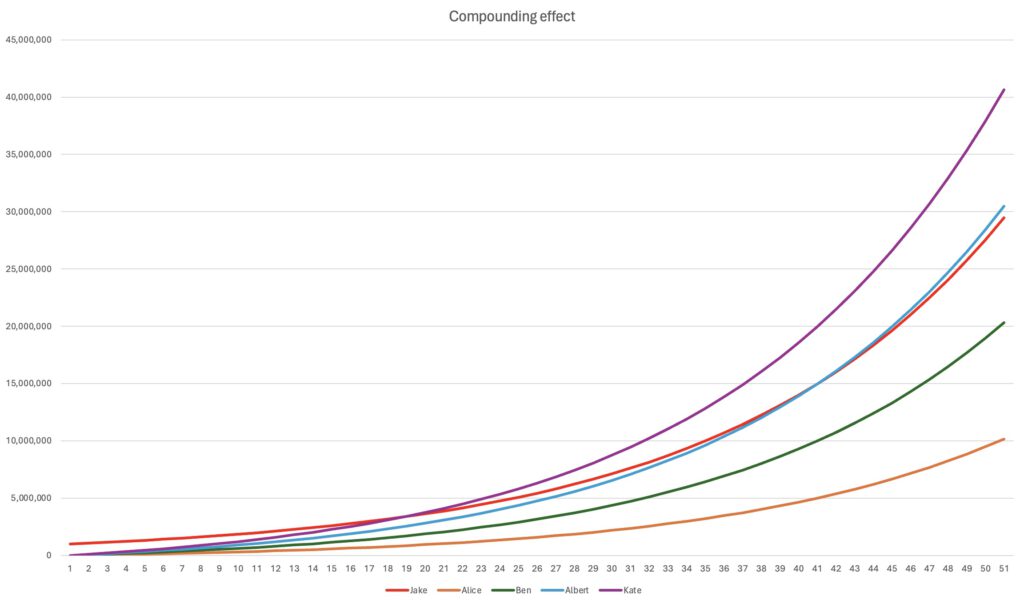

Below you see a table of 5 persons, Jake has from the start a capital of 1 000 000$ that he has invested in a global index fund, he doesn’t put in any more money. The rest have no start capital but are investing a large amount each year. Let’s be a bit conservative and calculate that they everyone is getting a 7% return each year.

How long do you think it will take before Alice, Ben, Albert, and Kate are richer than Jake?

| Name | Capital | Saves each year |

| Jake | 1 000 000 | 0 |

| Alice | 0 | 25 000 |

| Ben | 0 | 50 000 |

| Albert | 0 | 75 000 |

| Kate | 0 | 100 000 |

The compound effect

The compound effect is a principle that shows how small, consistent actions can lead to significant outcomes over time. In finance, we are often talking about the magic of compounding interest. To put it simply, compounding interest means earning interest on interest, which can turn your initial savings into huge sums over the years. One other way to think about it is also the analogy with the Snowball effect. You start with a small snowball, but as it rolls down the hill it gets larger and larger faster and faster.

For example, if you start with $1,000 in an investment account that offers a 7% annual interest rate. In the first year, your $1,000 earns $70 in interest, giving you a total of $1,070. In the second year, you don’t just earn interest on the initial $1,000; you also earn it on the additional $70, leading to about $74.90 in interest for that year, and a total of $1,144.90. This cycle continues year after year.

After 10 years, without saving any more money in your account, your initial savings of $1,000 grows to about $1,967, almost doubling your money through the power of compounding alone. This principle doesn’t just apply to finance. In life, consistent, incremental efforts in your personal development, skills, or habits can compound, leading to outcomes far greater than the sum of their parts. Whether it’s learning a new language, exercising, or saving money, small and steady investments can bring about transformative changes over time. The key is consistency and time, allowing the compound effect to work its magic. Just think what would happen if you just try to improve by 1% each week, the changes will be huge in the long run!!!

And the result

The scary thing is that Alice and Ben will never catch up with Jake. And it will take Albert 40 years of saving 75 000$ each year before he passes Jake. This really blows my mind…

Conclusion

This really shows how important it is to build wealth as early as possible and let the compound effect do its magical work! The classic approach is to get started early in life and begin saving the extra income you can get. For example, taking a job through vacations and so on. When you leave school and get your first real job, instead of moving out of your parent’s home, pay a small rent and save as much as possible to get the Snowball rolling. And later in life as a base rule always set aside at least 10% of your income before spending any money.

In a future post, let’s explore some alternative ways on how you potentially can get the snowball rolling. There are safe ways that almost guarantee financial success in the long run, but are there ways in how you can achieve it faster and get the snowball even bigger?